Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO

Links relacionados

-

Similares em

SciELO

Similares em

SciELO

Compartilhar

Visión de futuro

versão impressa ISSN 1668-8708

Vis. futuro vol.15 no.1 Miguel Lanus jun. 2011

ARTÍCULOS ORIGINALES

Régimen de Coparticipación de la Provincia de Misiones

José Garzón Maceda

Universidad Nacional de Misiones. Facultad de Ciencias Económicas -Finanzas Públicas. Centro de investigación de la Facultad de Ciencias Económicas

Campus Universitario Ruta 12 KM 7½ Miguel Lanús Misiones

E-mail: Jose_maceda@hotmail.com

RESUMEN

El presente trabajo analiza el mecanismo de coparticipación entre los distintos niveles de gobierno en la Argentina y busca, como objetivo central, dar una explicación acerca de la imposibilidad de encontrar un camino hacia la reforma del sistema vigente desde 1988 a pesar de los numerosos proyectos de ley presentados en el ámbito de la Cámara de Representantes de Misiones.

En primer lugar se rastrea el origen de la coparticipación en Misiones y sus distintas modificaciones hasta llegar al esquema actual que fue determinado en el año 1998. En segundo lugar se realiza un breve análisis de la evolución de la población misionera para intentar demostrar que resulta necesaria una reforma de este mecanismo de asignación de recursos para los municipios para luego recorrer las diferentes propuestas de reforma que se sucedieron en la Cámara de Representantes de Misiones, para finalmente y a modo de conclusión esbozar breves hipótesis que explican las dificultades de encontrar consenso para lograr modificar la coparticipación provincial.

PALABRAS CLAVE: Coparticipación; Reforma; Ley; Misiones; Administración; Finanzas.

INTRODUCCIÓN

La coordinación financiera entre distintas jurisdicciones, necesariamente se debe desarrollar cuando nos encontramos con distintos niveles de gobierno en materia fiscal.

Como lo señalan Musgrave y Musgrave (1999) la estructura fiscal multijurisdiccional, tal como se impone en cualquier país concreto, refleja las fuerzas históricas de la construcción de naciones, guerras y geografía. Al analizar nuestro país nos encontramos con que de las sucesivas luchas entre unitarios y federales, se fue construyendo un país con un sistema Republicano Representativo y Federal.

En materia de recursos y asignaciones, corresponde ver si los bienes y servicios que provee el Estado son provistos en forma centralizada o descentralizada y si la descentralización de servicios hacia las distintas jurisdicciones es acompañada con los recursos necesarios.

El problema consiste en el reparto de atribuciones y tareas entre los distintos niveles, abarcando tanto el aspecto de los recursos como el de los gastos, ya sea para la antigua concepción de las finanzas donde se buscaba la optimización de la asignación de recursos para satisfacer las necesidades públicas mediante la prestación de servicios o, como lo miran las finanzas modernas, con los aspectos de redistribución, estabilización y desarrollo económico.

Si bien no se agota el esquema de coordinación financiera en el reparto de los ingresos, al que le damos la misma importancia que la asignación de los gastos, centraremos nuestro enfoque en los recursos.

Como lo señala claramente Jarach:

"La distribución de los gastos y recursos entre los diferentes niveles de la Organización estatal debe tender a asegurar el respeto de los principios de igualdad y equidad que la conciencia social considera válidos respecto de los individuos y grupos afectados por la actividad financiera del Estado." (Jarach,D., 1996, p. 135)(1)

Es fundamental que estos aspectos además de analizarlos desde el aspecto de la distribución de la carga tributaria sobre los contribuyentes en virtud de los esquemas tributarios de los distintos niveles, lo debemos ver también desde la decisión de volcar los ingresos a la sociedad con idénticos principios y atendiendo los aspectos de redistribución y desarrollo económico.

Claro está que la función de redistribución del ingreso de un país con un régimen federal como el nuestro debe ser asignada al gobierno nacional y desde los distintos lugares de representación social (legislaturas, sociedad civil, gobiernos provinciales, intendentes, concejales, organizaciones) se debe controlar y exigir que se lleve a cabo con equidad y justicia social.

Es importante insistir en que la coordinación financiera debe responder a ciertas premisas o postulados políticos y presenta contrastes tales como los que propone Jarach: "Se plantean entre las exigencias políticas de autonomía de los Estados miembros respecto del estado federal y de las Municipalidades frente a los estados, por un lado y las exigencias racionales económicas y financieras de la mejor utilización de los recursos" (Jarach,D., 1996, p. 139)(2). Por ello señalamos que las soluciones a objetivos contradictorios son de neto corte político y en función de qué concepción de Estado y gobierno federal se tenga.

A través de este marco conceptual, se pretende en el presente trabajo, mostrar cuál es el mecanismo de Coordinación vertical entre el Estado provincial y los municipios que tenemos en la provincia de Misiones, particularmente la Coparticipación de recursos a los municipios, estudiando sus antecedentes históricos, su régimen vigente desde 1988, cuáles han sido los proyectos de modificación que se han presentado en la Cámara de Representantes de Misiones, sus coincidencias y diferencias y sobre todo buscar medianamente una explicación del por qué a la fecha no se ha podido sancionar un nuevo régimen de coparticipación provincial de impuestos.

DESARROLLO

Antecedentes de Coparticipación en la Provincia de Misiones

La Constitución de la provincia de Misiones sancionada el 21 de Abril del año 1958, en su artículo 74 hace referencia con claridad a la participación que le compete a los municipios de la percepción de los impuestos o contribuciones. Dicha participación se debe hacer efectiva por lo menos cada tres meses con cargo por incumplimiento directamente al Gobernador, Ministro del área y al Contador General de la provincia.

En función de este mandato constitucional, la Cámara de Representantes sancionó en el año 1963 la ley Nº 175 donde:

-

Se establece que el 8% es el porcentaje a distribuir entre las municipalidades y Comisiones de fomento;

-

Limita la coparticipación a lo recaudado por el Impuesto Inmobiliario, Actividades Lucrativas (hoy Ingresos Brutos) y lo recibido por Coparticipación Nacional.

- Señala que la liquidación se hará mensualmente por la Contaduría de la Provincia.

En noviembre del año 1977 se sanciona un sistema de Coparticipación a los municipios (Ley Nº 900) donde se establece qué impuestos conformarán la masa coparticipable, forma de distribución, parámetros para tomar los indicadores, disposición para que se confeccionen los coeficientes de distribución, remisión automática a los municipios dentro de los 30 días, facultad para otorgar anticipos, no afectación de los recursos hasta que se depositen y define como organismo de aplicación a la Dirección General de Presupuesto. Es decir que nos encontramos con un sistema que mantiene el porcentaje de distribución del 8%, pero que agrega dentro de los impuestos a coparticipar al Impuesto al Parque Automotor.

En otro orden, el mecanismo para distribuir lo recaudado, se estableció de la siguiente manera: 20% en partes iguales, 20% directamente proporcional a la población y el 60% en proporción directa a la recaudación obtenida por cada municipio de los impuestos coparticipables (carácter devolutivo).

En el año 19791, se profundiza la decisión de la transferencia automática que le corresponde a los municipios, su no afectación e instruyendo al Banco de la Provincia de Misiones -entonces, agente financiero del Estado-, que los montos que ingresen por coparticipación nacional que corresponda a la masa coparticipable con los municipios no ingrese a la cuenta de la tesorería general de la provincia.

Ese mismo año, pero en el mes de noviembre, el gobierno de facto de la provincia sanciona la ley 11892 que deroga la ley 900 y establece un nuevo régimen, cuyas características son las siguientes:

a) Mantiene el 8% en la distribución a los municipios de los impuestos e ingresos coparticipables;

b) Hace una afectación específica al municipio de Puerto Iguazú del 3%, quedando el restante 97% con la distribución establecida en la Ley 900.

c) Elimina el plazo de 30 días y establece que el Banco Provincia de Misiones deberá transferir los fondos a los municipios en forma automática sin ingresar a la Tesorería de la Provincia.

Este régimen mantiene la base de la ley 900, no encontrando justificativos del por qué otorgar al municipio de Iguazú un 3%, entendiendo que lo que buscaba el Poder Ejecutivo era fomentar el crecimiento del Municipio donde se encuentran las Cataratas del Iguazú, cara visible del turismo de la Provincia.

Como para cerrar el año 1979, el 28 de Diciembre, Día de los Santos Inocentes, el Gobernador sanciona la Ley Nº 1212, donde establece que los recursos de jurisdicción provincial (impuestos y contribuciones) que se coparticipan, se harán con el 8%, en tanto que los provenientes del régimen de coparticipación nacional solamente el 6%, modificando de esta manera la distribución primaria provincial.

Con la instauración de la Democracia en el año 1983, a los cuatro meses, se sanciona la Ley Nº 2089 que deja sin efecto la Ley Nº 1212 y reimplanta el régimen establecido en la Ley Nº 1189, también del gobierno de facto, avalando de esta manera el sistema que se había establecido, donde sobresale el trato preferencial del municipio de Puerto Iguazú.

Pasan cinco años y medio sin que se modifique el régimen, hasta que en el año 1988 la nación sanciona la Ley Nº 23.548 conocida como Coparticipación Federal de Impuestos y la provincia, en agosto de ese mismo año, sanciona la Ley Nº XV -Nº 10 (antes 2535), estableciendo el régimen de coparticipación que rige en la actualidad.

Los intentos de reforma del Régimen vigente

Evolución de los municipios 1980-2009

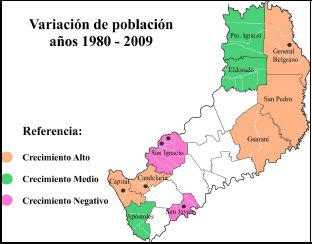

El año 1998 fue el último que conoció una reforma del sistema de coparticipación, pese a los cambios poblacionales sufridos por la provincia, la región y el país. No obstante han existido intentos de reforma. Brevemente analizaremos algunos proyectos presentados por legisladores de distintas bancadas, que consideramos relevantes y que no han sido sancionados, no sin antes exponer que la reforma resulta claramente necesaria si se observan algunos indicadores de evolución de los diferentes municipios de Misiones que presentamos a continuación para el período 1980 - 2009 y la alta dependencia en los presupuestos analizados de la coparticipación municipal.

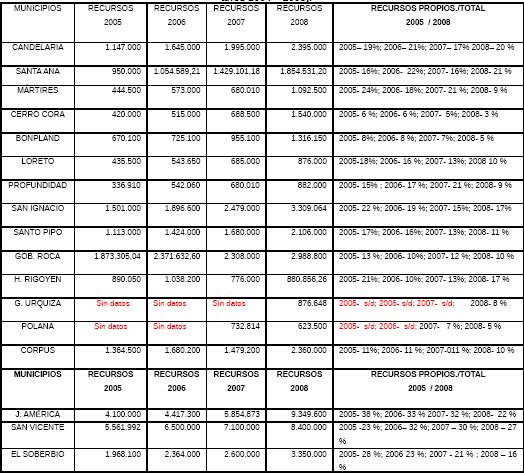

De la observación del cuadro que mostramos abajo se desprende que el 87% de los recursos de los municipios, corresponden a ingresos de otras jurisdicciones, donde los provenientes de la coparticipación son los más importantes y puede notarse que en el período analizado, la participación de los recursos de jurisdicción propia, respecto del total de los recursos tiende a decrecer.

Cuadro 1: Origen recursos municipales -recursos propios sobre total de ingresos (presupuestos años 2004 - 2008)3

Fuente: Elaboración propia en función a las ordenanzas municipales

Los municipios con más población, con más actividad económica, muestran una situación mejor que aquellos municipios pequeños, debiendo focalizar en ellos, prioritariamente, el proyecto de desarrollo.

En cuanto al crecimiento de la población en los últimos 20 años podemos subrayar que tomando a la provincia de manera global, el departamento General Manuel Belgrano es el que tiene mayor crecimiento en el período 1980-2009 (278,23%). El crecimiento sostenido se dio en el municipio de Andrés Guacurarí. Bernardo de Irigoyen tuvo su mayor crecimiento en el período 1980 a 1991, y San Antonio de 1991 al 2001.

El departamento Candelaria es el segundo en crecimiento (193,41%), sobresaliendo Candelaria, Profundidad y Santa Ana. Presenta un importante decrecimiento en el municipio de Cerro Corá.

El departamento Iguazú presentó su mayor crecimiento en 3 de 4 municipios (Wanda, Iguazú y Libertad.

El departamento Oberá presenta en sus municipios integrantes todas las particularidades: crecimiento constante en Campo Ramón y Colonia Alberdi; crecimiento en disminución en Oberá, Guaraní y San Martín. Y crecimiento negativo constante en General Alvear.

El departamento San Ignacio, a pesar de tener un crecimiento medio interesante desde 1980 al 2009 (63,81%), tiene dos municipios con crecimiento negativo en su población (Colonia Polana y General Urquiza).

San Javier es el departamento que mayor crecimiento negativo presenta, 3 de sus 4 municipios integrantes han disminuido su población desde 1980.

Figura 1: Provincia de Misiones. Variación de la población 1980-2009

Fuente: Elaboración propia en base Censos Nacionales - INDEC - IPEC

Coparticipación provincial: proyectos de reforma

En toda la década del '90 el tema no fue considerado en la agenda legislativa de los diferentes bloques. Recién con la crisis del año 2001 comienzan a presentarse algunos proyectos que buscan reformar el régimen de coparticipación vigente en la provincia de Misiones. Sobresale el proyecto (Expediente D- 18481/02) presentado por el diputado José L. Dieminger4 en Mayo del año 2002, donde se plantean los siguientes aspectos:

a) establece un régimen completo y un sistema nuevo;

b) eleva la distribución primaria del 12% al 16% (aumento del 33,33%)

c) Integra como coparticipables a todos los recursos provinciales y otros de jurisdicción nacional.

d) Crea un Fondo de apoyo municipal del 1% para atender necesidades de urgencia;

e) Considera variables como la población, Necesidades Básicas Insatisfechas (NBI), recursos propios del municipio sobre los gastos del mismo; erogaciones de capital sobre erogaciones totales; población del municipio sobre gastos.

f) Particiona la transferencia durante el mes a los municipios a su cuenta operativa;

g) Crea la Comisión de Coparticipación Municipal, con participación del Poder Ejecutivo y Legislativo y establece las funciones de la misma.

Es importante destacar que la Unión Cívica Radical (UCR) como partido no gobierna la Provincia de Misiones desde el año 1987, por lo que más allá de lo interesante de debatir un nuevo esquema, la cuestión partidaria y financiera del país y la provincia en esos tiempos hizo que no se considere el mismo.

A mediados del año 2004, el Diputado Luis A. Giuliani5, presenta un régimen (Expediente D- 18481/02) que en sus conceptos es similar al analizado anteriormente, con algunas improntas, pero estructuralmente igual.

El juego del Poder entre mayorías y minorías lleva a no tratar estos proyectos, pudiendo esbozar una idea de que a quienes manejan el poder cualquiera sea su color político, no les conviene modificar el sistema actual en función de la sumisión de las administraciones municipales.

En Julio del año 2004, Luis Kornuta, quien fuera diputado provincial ese año por el Partido Justicialista, presentó una modificación a la Ley 2535 (Expte. D 23716/04), proponiendo destinar del total de la masa coparticipable un 3% a la creación de un Fondo para Emprendimientos Productivos que serían administrados por las municipalidades.

Si bien el legislador es del Partido Justicialista (P.J), no integra el partido que desde el año 2003 gobierna la provincia. El Frente Renovador, un Frente conformado por justicialistas, radicales e independientes, por fuera de los partidos tradicionales, por lo cual no obtuvo el aval político para su tratamiento y aprobación.

En Febrero del año 2007 el diputado provincial Ricardo Biazzi, también Justicialista, plantea introducir como una enmienda el esquema de coparticipación en la Constitución de la provincia. Esta iniciativa se condice con su pensamiento y actuación en la Convención Constituyente del año 1994 que incluyera el régimen en el art. 75 inciso 2 de la Constitución Nacional, en virtud de representar a Misiones en aquella histórica oportunidad.

El proyecto toma la misma filosofía del artículo 75, elevando el porcentaje de distribución primaria del 12% al 20% de todos los recursos provinciales y nacionales que reciba la provincia. Establece que este porcentaje se alcanzará en tres años.

A la fecha, el proyecto no ha sido considerado por no encontrar los apoyos correspondientes, tanto en los bloques oficialistas como en la oposición, no incluyéndose en la agenda legislativa.

En el mismo mes de febrero del año 2007, a inquietud de intendentes, el bloque del Partido Justicialista de la Cámara de Representantes presenta un proyecto de ley para modificar la distribución primaria del 12% al 16% y una distribución secundaria de emergencia para algunos municipios. Dicho proyecto no ha encontrado el apoyo de la mitad más uno de los legisladores, tanto del oficialismo como de la oposición para su tratamiento y aprobación.

En marzo del 2007 el Diputado Timoteo Llera, presenta un proyecto6 donde se pretendía modificar por una parte, el porcentaje de la distribución primaria del 12% al 15% y también se incluye como impuesto coparticipable al impuesto de Sellos. Establece mecanismos para determinar la distribución donde la población juega un importante rol (60%) más otros parámetros como ser: inversa costo salarial, recaudación tributos municipales partes iguales, entre otras, y se crea una Comisión Ejecutiva Fiscalizadora del régimen de Coparticipación integrada por representantes del Poder Ejecutivo y Municipios, estableciendo las funciones de la misma.

Tampoco este proyecto ha encontrado eco en la Cámara de Diputados para establecer nuevas relaciones financieras entre los municipios y la provincia.

En síntesis, la provincia de Misiones desde su Constitución del año 1958 establece la relación financiera que debe existir entre la provincia y sus municipios, particularmente lo que se refiere al régimen de distribución de recursos para que estos puedan cumplir sus objetivos. Y aunque desde el año 1963 a la fecha existieron diferentes relaciones en materia de coordinación financiera vertical en la provincia, desde 1988 a la fecha, al igual que lo que ocurre a nivel nacional, no se ha podido cambiar el régimen vigente, sobre todo en lo relacionado con la masa coparticipable, en la distribución primaria y la distribución secundaria.

La falta de aplicación de maneras diferentes de relación financiera, entre los niveles de gobierno, que incluyan nuevos parámetros, exigencias, cambios de paradigmas de gestión ha llevado, entre otras cosas, a los municipios tener una mayor dependencia para financiar sus erogaciones, de los recursos provenientes de jurisdicción nacional o provincial, generándoles una vulnerabilidad política importante, que, de alguna manera impide la implementación plena del principio de autonomía establecido en la Constitución Nacional y la Constitución Provincial.

CONCLUSIONES

Luego del recorrido por los diferentes mecanismos de coparticipación y los varios intentos fallidos de reforma desde 1988 surge la pregunta: ¿por qué distintos legisladores, de distintos bloques políticos, en distintas épocas no han podido lograr introducir un nuevo régimen de coparticipación en la provincia o bien mejoras sustanciales al régimen vigente?

Como conclusión, ofrecemos aquí algunas respuestas:

En primer término, entendemos que no se ha buscado en cada tiempo los consensos necesarios dentro de la legislatura para instalar en la agenda legislativa el tema, privilegiándose en cambio, sectorial o individualmente el protagonismo por sobre el proyecto.

En segundo término, no se ha visto surgir de quienes deberían ser los principales interesados, los intendentes, plantear la necesidad política de una nueva relación financiera con la provincia.

En tercer lugar, la sociedad no ha tomado como propio este tema y tampoco se muestran, en general, gestiones municipales de excelente administración que generen confianza en el manejo de los recursos, que lleven a la necesidad de debatir el tema y cambiar las normas vigentes.

En cuarto lugar, al existir una deuda pendiente del Congreso Nacional de sancionar un nuevo régimen de coparticipación para el país, de acuerdo a los parámetros dispuestos en la Constitución Nacional, donde Misiones debería mejorar su participación, arrastra consigo el suspenso del debate provincial de una nueva manera de coordinación financiera entre el Estado provincial y los municipios misioneros.

Nos es imposible soslayar que existe una deuda pendiente de varias administraciones locales, de encontrar la manera de ser más eficientes y eficaces a la hora de aplicar su política fiscal y sobre todo en el diseño de políticas tributarias que le permita hacerse de los recursos de su propia jurisdicción.

Entendemos que se pueden ir estudiando las diferentes alternativas que permitan generar el debate entre los diferentes actores, ya sean intendentes, legisladores provinciales, organizaciones sociales y empresariales, con la mayor difusión y participación social posible, dado que cualquier decisión que se tome para modificar coeficientes, masa coparticipable, impuestos coparticipables, mecanismos transparentes de control de los envíos en tiempo y forma de los recursos, nos involucra a todos, considerando que nos veremos beneficiados o perjudicados como ciudadanos en función del municipio o zona de la provincia que habitemos.

Creemos necesario, conociendo la vulnerabilidad política, ir generando el ámbito para el estudio de una nueva estrategia para el desarrollo de los municipios de nuestra provincia, buscando recuperar la confianza de una sociedad que se encuentra alejada de la administración de los recursos públicos, dejando de lado planteos demagógicos y centrar el estudio en fuertes contenidos de nuevas maneras de Gestión Pública, que cambien los paradigmas vigentes, planificando una Misiones para los próximos 15 años.

Sin lugar a dudas, la capacitación, la formación de los recursos humanos locales y provinciales de los distintos rangos jerárquicos en materia de Gestión, Administración y Organización de la Hacienda Pública, aportará la base firme para encontrar los objetivos propuestos. Sin lugar a dudas Misiones ocupa un lugar de avanzada en el país en esta materia.

NOTAS

1. Ley 1143 de fecha 22/08/79.

2. Se señala que en el instrumento, se hace referencia a las Facultades conferidas por la Junta Militar en el artículo 1º inc. 3.2 de la instrucción Nº 1/77. No habla de Decreto Ley, sino de Ley propiamente dicha.

3. El siguiente cuadro se basa en un estudio previo de mi autoría que fue presentado como Tesis para la Maestría en Gestión Pública de la Universidad Nacional de Misiones y que toma los 17 municipios expuestos como muestra de análisis.

4. Diputado (Mandato Cumplido) UCR, Intendente varios períodos y en ejercicio en la actualidad del Municipio de Puerto Rico.

5. Diputado (Mandato Cumplido) por la U.C.R

CITAS BIBLIOGRÁFICAS

(1) JARACH, D. (1996). Finanzas Públicas y Derecho Tributario 3º. Bs As, Ed. Abeledo - Perrot, Pág. 135.

(2) JARACH, D. (1996). Finanzas Públicas y Derecho Tributario 3º. Bs As, Ed. Abeledo - Perrot, Pág. 139.

BIBLIOGRAFÍA

1. BRIZUELA, O. et. al. (2005). Lineamientos Generales la Formulación de una Nueva Ley-Convenio de Coparticipación. Posadas, Editorial Universitaria, Universidad Nacional de Misiones. [ Links ]

2. CAO (COORD) et al. (2007). Introducción a la administración pública nacional, provincial y municipal, Buenos Aires, Biblos. [ Links ]

3. CECONI, J. (2006). Estudios Sobre Derecho Municipal y Federalismo. Buenos Aires, El Derecho. [ Links ]

4. ITURRIOZ, E. (1981). Curso de Finanzas Públicas. Bs As, 2º ed. Macchi. [ Links ]

5. JARACH, D. (1996). Finanzas Públicas y Derecho Tributario. Bs. As, 3º ed. Abeledo-Perrot. [ Links ]

6. LOUSTEAU, M. (2003). Hacia un Federalismo Solidario: La Coparticipación y el Sistema Provisional: Una Propuesta desde Economía y la Política. Buenos Aires, Temas Grupos Editorial. [ Links ]

7. MUSGRAVE, R. y MUSGRAVE P. (1999). Hacienda Pública: Teoría y Aplicada. Madrid, 5º ed. McGraw-Hill. [ Links ]

8. Expediente D 18481/02 Proyecto de Ley Diputado (M.C.) José Dieminger. Disponible en http://www.diputadosmisiones.gov.ar/content.php?id_category=32%26id_exp=4875%26pag=old [ Links ]

9. Expediente D 23436/04 Proyecto de Ley Diputado (M.C.) Luis A. Giuliani. Disponible en http://www.diputadosmisiones.gov.ar/content.php?id_category=32%26id_exp=3328%26pag=old [ Links ]

10. Expediente D 23716/04 Proyecto de Ley Diputado (M.C.) Luis Kornuta. Disponible en http://www.diputadosmisiones.gov.ar/content.php?id_category=32%26id_exp=3573%26pag=old [ Links ]

11. Expediente D 29261/07 Proyecto de Ley Diputado Ricardo Biazzi. Disponible en http://www.diputadosmisiones.gov.ar/content.php?id_category=32%26id_exp=16893%26pag=old [ Links ]

12. Expediente D 29286/07 Proyecto de Ley Diputados Bloque PJ. Disponible en http://www.diputadosmisiones.gov.ar/content.php?id_category=32%26id_exp=16916%26pag=old [ Links ]

13. Expediente D 29396/07 Proyecto de ley Diputado (M.C.) Timoteo Llera. Disponible en http://www.diputadosmisiones.gov.ar/content.php?id_category=32%26id_exp=17254%26pag=old [ Links ]

14. Ley provincial Nº 175 (Abrogada implícitamente). Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20D%20Abrogacion%20Implicita.pdf [ Links ]

15. Ley provincial Nº 900 (Abrogada expresamente). Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20E%20Abrogacion%20expresa.pdf [ Links ]

16. Ley provincial Nº 1143 (Abrogada expresamente). Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20E%20Abrogacion%20expresa.pdf [ Links ]

17. Ley provincial Nº 1189 (Abrogada expresamente). Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20E%20Abrogacion%20expresa.pdf [ Links ]

18. Ley provincial Nº 1212 (Abrogada expresamente). Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20E%20Abrogacion%20expresa.pdf [ Links ]

19. Ley provincial Nº 1319 (caduca por objeto cumplido). Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20C%20caducidades.pdf [ Links ]

20. Ley provincial Nº 2089 (Abrogada expresamente). Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20E%20Abrogacion%20expresa.pdf [ Links ]

21. Ley provincial Nº XV Nº 10 (2535) (1988), Régimen de coparticipación municipal. Disponible en http://www.diputadosmisiones.gov.ar/digesto/Consultas/documentos/10LP-2535.pdf [ Links ]

22. Ley provincial Nº XV Nº 12 (antes ley3875) (2002) y modificatoria 4376 (Abrogada expresamente) (2007) - Adicional mensual de Coparticipación municipal. Disponible en http://www.diputadosmisiones.gov.ar/digesto/Consultas/documentos/12LP-3875.pdf y http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20E%20Abrogacion%20expresa.pdf [ Links ]

23. Ley provincial Nº 3961 (Abrogada expresamente) Coparticipación Municipal en el marco de la emergencia económica.- Sus modificatorias. Disponible en http://www.diputadosmisiones.gov.ar/digesto/ANEXO%20E%20Abrogacion%20expresa.pdf [ Links ]