Introduction

The Spanish wine sector is immersed in a constant process of change because of increased competition in an increasingly global and international market. Castilla La Mancha (Spain) is the largest wine-growing region in terms of surface area in the European Union, so knowledge of the competitiveness of its wineries is a significant factor. This region has a unique feature compared to other wine-producing regions, which is the cooperative sector’s enormous weight. This balance between private wineries and cooperatives justifies the importance of this study.

In the period analyzed (2002-2011), two milestones have had a substantial though unequal impact on the wineries. Firstly, the industry has undergone a significant restructuring because of a legal transformation in the Common Market Organization (CMO) and secondly, the financial crisis after 2007. The wine cooperatives have made substantial efforts in terms of strategies. Cooperative integration and the food chain law (Law 12/2013, August 2) and the creation of the Interprofesional del vino [Spanish inter-professional wine organization, 2014)], have also entailed regulatory changes and incentives for the modernization of business processes and inter-sector relations, and the relationship between value chains structures.

To cope with the post-2007 economic crisis, the cooperatives opted for financial caution, cost reduction based on lower settlements to partners (self-financing) and above all, for the establishment of second-degree cooperatives. Baco is a second-degree cooperative consisting of eight first-degree wine coops and had a turnover volume of 40 million euros in 2011. It merged with DCOOP (olive oil, Andalusia) in a cooperative integration process under Ley 13/2013 de Fomento de la Integración Asociativa [ Association Promotion Law]). This involved large bulk volumes and the need to export at much more competitive price levels compared to other world production areas. Nonetheless, it is necessary to highlight the small size of the CLM cooperatives even after the merger compared to their French and Italian counterparts.

The purpose of this paper is to study whether there exist differences in the wine cooperatives’ performance as a result of the significant sector transformation. The reaction of wine cooperatives and the strategies they developed were substantially different from those adopted by private wineries. They former used distinctive characteristics of the cooperative movement, which allowed them to survive, adapt and find solutions during changing situations in the context of an economic crisis (from 2007) or the modification of the CMO 13.

The organization of this paper is as follows. First, we present the wine sector in Castilla-La-Mancha, the most significant region in production terms, and its context. Second, we describe the competitiveness of the wineries and their efforts to capture a competitive advantage and survive in a period of financial crisis. Third, the database and the methodology used and fourth, the results. Finally, we draw some conclusions and recommendations.

The wine sector in Castilla-La-Mancha (Spain)

Castilla-La-Mancha - CLM is the most significant wine region in Spain and the E.U. It sells the largest volume of wine and must. Table 1 shows that CLM represents 9.7% of Spanish wineries and sold 56% of the nation’s wine volume in 2014-2019.

Table 1: Importance of the wine sector in Castilla-La-Mancha (Spain).

Source: 23,27,32,33 and authors

CLM hosts 218 wine cooperatives out of a total number of 425 in Spain. Some of these wine cooperatives are larger than private wineries (IOF) in terms of average firm size. In 2013, only 27 out of the 580 wineries produced more than 50,000 hl, and almost 70% 19 of these 27 wineries were cooperative associations 16.

Wine cooperatives in CLM base their competitive position on winegrowers carrying out intensive farming, which provides a much higher average yield than the national mean. It is also essential to remember that wine cooperatives represent 67.5% of the vineyard area at the regional level 32.

In terms of volume of exports, CLM represents 52.4 % of total Spanish exports. However, it only reaches 27.1% of the Spanish total in terms of value. This situation shows a specialization in large bulk volumes, in which cooperatives are the main actors 37. The export volume from CLM set a record with 15.1 million Hl commercialized in 2017 in international markets; only 25% of the wine produced remained in the Spanish domestic market in the form of distillations (byproducts and potable alcohol) and must. The main destinations for CLM’s wine are EU countries -and due to the border effect- France, Portugal, Italy, and Germany. CLM wine’s low average export price is significant: 0.67€/l in CLM vs. a Spanish median of 1.29€/l 32.

Airén is the main grape variety in CLM. It is considered a prime example of a bulk winemaking grape, and it is closely associated with regional cooperative production. It fell in hectares cultivated from 338,000 (2000-2007 average) to 215,000 in 2013 while unit yields increased exponentially to produce record harvests in 2013. The fact that wine-growing holdings have had access to significant budget aid to start vineyard reconversion and restructuring irrigation and trellis systems has also been a determining factor. Regarding the CMO Restructuring and Conversion of Vineyards, CLM invested 842 million euros during the 2001-2012 period (more than 50% of the funding allocated to Spain for this end), and no fewer than 130,000 hectares were converted out of a total of 465,000 throughout the region 38. Wine cooperatives represent approximately 50% of AOC area wine sales (8.5 million hl). However, cooperatives have a high level of efficiency in comparison with non-cooperative wineries 13.

Competitiveness in the wine sector: measurement indexes and hypotheses

The contribution of this paper is to identify different profiles of wine cooperatives and show their performance in order to understand their financial strengths. When performance is analyzed, we consider companies’ operating and financial results measured based on accounting variables.

Arguments for and against using different strategies to compete in the market are related to typologies of cooperatives. Based on previous papers 10,11,19,21,35,44, we identified different strategies used by cooperatives to be resilient to changes arising from the financial crisis and changes in legal regulations.

Social economy companies withstood the crisis better due to their objective function (maximizing cooperative owners’ income) and thanks to their flexibility in terms of grape payment policies 1,24,41.

The importance of economic performance as a result indicator is unquestionable, and it is in this light that we analyze company survival and solvency 17,25. Traditional profitability ratios such as ROA or ROI do not reflect cooperatives’ objectives. We propose another ratio, Return of Cooperative Member (ROC), comparing these measures to assess performance 12,43.

Performance aside, the economic crisis has also substantially changed companies’ financial situation. Therefore, adopting resilience strategies has a direct effect on liquidity and debt indicators 3. Namiki, 2013 analyzes liquidity and leverage. In terms of leverage, Amendola et al. 2012 (correlated the debt ratio of Italian companies with lower indebtedness. Other studies 19 compared cooperatives and private businesses in Italy. They conclude that cooperatives based their emergence out of the crisis on higher levels of solvency and efficiency, as opposed to private companies, which mainly used their availability of liquidity as a shock strategy through the economic depression stage. The case of Spain highlights the export outlet as a factor for a notable increase in cooperative sales despite the barriers to cooperative internationalization 22.

Therefore, and based on the previous variables, we intend to test the hypotheses below, designed to control for variations in performance.

Environmental variables

Environmental and context changes have modified the competition rules in the sector. Studies related to wineries’ economic-financial situation focus their attention on the strategies developed in the countries of research in “Old Europe.” In Italy, wine cooperatives’ need to adapt is associated with globalization 8. Portuguese wine cooperatives are facing difficulties in operating in a more competitive global market. They need to change their policy of maximum return to partners as this severely reduces their capacity to improve their debt structure and finance long-term investment 39. Studies on the Languedoc-Roussillon region in France point out the need to reconcile the maximization of grape payment to partners typical of the cooperative model with the need to generate reserves for long-term investment 40. Studies comparing Austria, Germany, and Italy 2 or France and Italy 15 distinguish cooperatives focusing on bulk sales and those focusing on the sale of bottled wine and conclude that diversification and segmentation are the strategies with the highest positive effects in terms of performance.

Economic development allows for studying large wine producers in developing countries. A differential factor was analyzed in Argentina, namely, whether cooperative owners obtain better prices for their raw material from non-associated producers 31. The case of Chile highlights the importance of cooperatives, even though three large companies dominate the Chilean market 29. Nguyen et al. (2013) analyzed growth and crisis processes in Australia, as did Cordery and Sinclair (2013) in New Zealand.

A common thread across these studies claims that wine cooperatives have systematically and dynamically adapted to changing world situations and to the regulatory and structural changes required by different scenarios to gain a competitive position and sustainability. Above all, it shows that the evolution of the wine sector in “Old Europe” countries cannot be understood without considering the cooperative sector’s fundamental role.

The primary purpose of this research is to analyze the resilience of cooperatives in the largest wine-producing region in a context of economic crisis and significant changes in public regulation, and the implications for their performance measures.

H1: There are no differences in Performance and Financial Situation due to environmental variables

Variables such as firm size and age modify ways of competing. From a theoretical point of view, large companies adapt better to environmental changes, so size has a positive effect on performance and financial situation measurements 42.

H1-1: There are no differences in Performance and Financial Situation due to size

Second, we formulated a hypothesis indicating that age affects performance and financial situation measurements. The effects of age on these measurements are contradictory. Age has a negative correlation with profitability in Gardebroek et al. ( 2010). By contrast, recent studies reveal a positive correlation derived from movements on the average costs curve 30, although previous studies showed results in the opposite direction 18. The debate about age leads to the following hypothesis:

H2: There are no differences in Performance and Financial Situation due to commercial strategies

One of the variables to consider is sales development. Increased competition levels and the fall in per capita consumption create marketing problems in wine trading. Added to this, an increase in average yield per hectare generates even more difficulty. In this context of competition, a fall in consumption and an economic crisis, sustaining a positive trend in sales is vital. Some studies correlate sales increase with ROA 9. This relation would entail that apart from quantity, average sales price also allows the recovery of costs and produce a profit margin.

H2-1: There are no differences in Performance and Financial Situation due to Growth of Sales

A further commercial strategy adopted by wineries is exporting. Companies positioning themselves abroad has led to the sale of significant volumes in new foreign markets. One of the reasons for the previous lack of presence on international markets is bulk commercialization instead of selling bottled wine. New investments in bottling, new packaging options (Bag in Box), and a competitive price policy has allowed for positioning and sales in non-traditional markets. Exports are related to the positive impact on the development of wine companies 5,33.

H2-2: There are no differences in Performance and Financial Situation due to Export activity

Modernization through investment has enabled cooperatives to make improvements in terms of production and commercialization. This investment, in some cases intensive in nature, was financed by EAFRD (European Agricultural Fund for Rural Development) Grants. Some studies 7 record the level of EAFRD aid to wine cooperatives in terms of support to quality promotion investment.

Materials and methods

We will test these hypotheses using a sample made up of financial statements of wine cooperatives (CNAE code 1102: winemaking) in CLM (Spain) recorded in the Registro de Cooperativas (Public Registrar’s Office). We created a longitudinal dataset by building a sector sample covering the 2002 -2011 period.

The original database included 45 cooperatives active in 2001; hence five coops were eliminated. The final database (40 cooperatives) is an unbalanced panel representing 18.3% of the wine cooperatives in CLM. However, if we consider the sales volume for 2011, our sample represents 23% of the cooperative sector and 18% of wine production in CLM.

This sample does not present problems in terms of the significance of the results. The sample error represents 6% at a 95% confidence level according to the estimation of error for finite populations and taking the assigned turnover for 2011 as the reference variable.

The bulk of the cooperatives in the sample are small (micro and small following E.U. criteria (20). The definition of variables was carried out based on the hypotheses formulated in the previous section, and they are either continuous or discrete (dummy) in nature (Table 2).

Table 3 shows the descriptive statistics of the variables analyzed.

This information shows that the 2007 crisis resulted in negative values for all performance measurements. The ROC variable, for instance, has a meagre minimum value, which indicates that the grape price paid to partners is also low. Therefore, the income received by cooperative members transfers the problem from the organization to winegrowers.

The indicators corresponding to the financial situation (Liquidity and Leverage) highlight the impact of the crisis, showing both a lack of short-term liquidity and an increase in indebtedness in this period.

The bulk of the cooperatives in the sample consists of micro and small cooperatives (85%). This percentage is similar to that of the Spanish industrial world, in which smaller companies are predominant.

The policies carried out in the 1960s-1970s, and the transition to democracy favored the creation of cooperatives, reaching 76% of cooperatives in this period. Between 2008 and 2015, the number of companies in the beverage manufacturing sector fell 10% in Spain, whereas in CLM, it fell only 3%. The cooperative sector has grown both in presence and activity level in this sector 28.

Cooperatives increased sales despite the crisis in the period studied. This fact highlights their resilience during crisis periods and the efforts made in terms of market orientation through increases in sales.

Export orientation (EXP) reveals the importance of the efforts made by cooperatives to expand into foreign markets. The lifting of distillation measures entailed a massive transformation of wineries as they needed to sell wine for distillation. 60% of the wineries in our sample sell part of their products in foreign markets. Finally, only 12% of cooperatives received EAFRD grants. This aid supported investment in the period analyzed.

The methodology used to test H1-H3 reflects the static aspects of cooperatives. It requires year on year comparison of the means and variances of each of the different variables across environment, commercial and financial situations using a standard t-test of the difference of two means and an F-test of equality of two variances between any two populations. Note that the term “no differences” in H1-H3 has two meanings, and the interpretations of the results presented in the next section will reflect that. The first meaning refers to its standard explanation, namely that the variable in question does or does not have the same value across the criteria considered. Hence, the test is one of equality versus non-equality of means. The second measures the alternative hypothesis and deals with the particular degree of profitability for the variable tested below that of their counterparts due to the specific nature of strategies. We test both cases by comparing the p-value of each test to a Type I error, α, of 0.1, and the following decision rule.

Decision rule

If (p-value)>α, conclude that there are no differences in the characteristic in question as a result of differences in variable considered.

If p-value<α/2, conclude that there are differences in the characteristic in question because the value of the said index is lower than for the counterpart.

If α/2≤p-value<α, conclude that there are differences in the characteristic in question, but not necessarily because the value of the said index is lower than that for the counterpart.

Results and discussion

Competitiveness and strategies developed by wineries

Table 4 shows the evolution of performance measurements over time.

Table 4: Evolution of performance measurements mean values.

Source: Authors.

Fuente: Elaboración propia.

Based on this information, it is safe to state that despite the crisis, wine cooperatives have maintained positive mean values in performance measurements, which supports cooperatives’ resilience within the different stages of the economic cycle.

However, if we analyze the global impact, all performance variables fell in the period studied. Let us consider the economic cycle in stages. We see that during the financial boom period, the performance indicators reflected negative values if we consider the traditional measures. It is worth noting that the ROS does not follow this pattern in this period, given that between 2002 and 2006, growth is positive (2.00) and that it became negative during the crisis (2007-2011). These results show that traditional performance measurements do not reflect the actual profitability level of cooperatives. There is, therefore, an accounting measurement problem in that it does not show the main objective of a cooperative measured as the transfer of income to cooperative owners.

Cooperative owner income fell in the overall period. However, if we observe its evolution by sub-periods, the situation is the opposite of that expected; the growth of the ROC is negative in the economic boom period, whereas it shows positive values during the crisis.

This result deserves special attention and will be discussed in subsequent sections. The financial variables reflect a variation in the liquidity ratio. During the period 2002-2006, this ratio was negative, probably related to the increase of the investment ratios of the wineries and, for the period 2007-2012 the liquidity increased 0.37% due to the austerity measures developed by the coops. There was also an increase in the debt ratio in the period 2007-2001, where the ratio growth was 10.5%.

Table 5 (page 92-93) shows this analysis results.

The results include the median values of the significant variables based on the preceding approach represented as mean values for the grouping variable.

Environmental variables

The weight of the size and age variables in accounting for performance measurements is uneven and concentrated in time. Thus, if we consider cooperatives’ average size, we see that it is not significant in the period studied. Even though they can go in both directions, the differences are concentrated in the 2008 financial year. 2008 is the year of the CMO (Common Market Organization) wine reform and the onset of the economic crisis. In this case, small wine cooperatives obtained worse results in terms of performance than medium-sized and large ones.

In terms of age, the bulk of cooperatives were established in the 1970s which provides them with expertise and stability. Older cooperatives should show better performance. However, we were not able to verify this conclusion given that as from 2005 results tend to be contradictory.

Commercial strategies

Changes in wine cooperatives’ structure and sales strategies have resulted in their transformation. These changes have in turn resulted from the new regulation of CMO and the creation of a new AOC in the region with a differentiated commercial strategy.

The first variable analyzed is sales growth. Our underlying assumption would be that wine cooperatives with a positive evolution of sales should show better performance indicators. These differences in favor of cooperatives with bigger sales volumes were concentrated between 2009 and 2011 when cooperatives with positive sales had better performance.

The second strategy adopted by wine cooperatives was foreign market expansion. The Spanish market shows falling rates of wine consumption, so cooperatives have had to opt for exporting to sell their wine. The underlying assumption was that there are no differences in performance measurements due to export orientation. The data in the corresponding table shows that the export strategy improved performance measurements in the period studied, particularly in the 2004-2010 period.

From a financial point of view, our results reveal mean differences, although the sign of the mean values is not conclusive given that liquidity falls and leverage increases. Foreign market sales have reduced wine cooperatives’ liquidity and increased debt to finance these liquidity problems.

Investment and CAP Policy

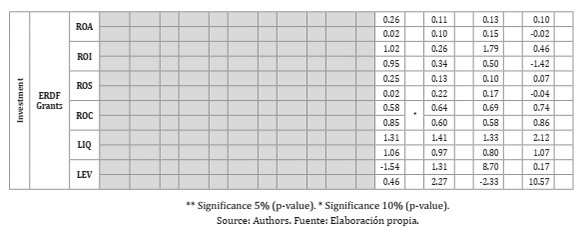

Here we will consider the variable corresponding to the impact of ERDF Grants on performance measurements.

In the E.U. framework, co-funding investment strategies carried out by companies in preferential areas are the target of financial support. Access to these grants materialized from 2008 when cooperatives with this source of funding obtained better performance indicators. However, these grants did not substantially modify performance measurements after 2008, probably due to the economic crisis.

Conclusions and further research

The importance of wine cooperatives in Castilla-La Mancha (Spain) is unquestionable. It is the region with the largest cultivated area and is one of the world’s top five wine-producing areas. However, its financial results do not match this leading position, neither measured in liters nor in terms of the wineries’ performance. It is thus of particular importance to analyze this phenomenon.

Wine cooperatives have in the last few years transformed themselves in terms of strategies and market orientation, and this has been as the result of two factors: first, the lifting of distillation measures has forced them towards market orientation to facilitate wine commercialization, and second, the economic crisis significantly affected this sector. Both wine consumption and price per litre fell.

Considering the results of this study, the cooperatives of Castilla-La Mancha have shown themselves to be resilient actors in the wake of the economic crisis, globalization, and changes in European public regulation. They have opened new export markets to counteract the decline of domestic consumption and the disappearance of the market grants for distillation. They have consolidated performance rates despite the widespread crisis scenario in the European economies. These results further show the causes of this behaviour, which coincide with earlier results obtained in European countries: France, Italy, Portugal, as well as in other producing countries: Argentina or Chile.

This analysis reveals those environmental variables unevenly affected performance measurements: Size does not appear relevant in this sector framework, whereas age allows access to better competitive positions based on cooperatives’ expertise.

From a commercial point of view, sales strategies have the most positive impact or have at least not been too detrimental due to the economic crisis. Cooperatives have survived in the market in times of crisis. Many of them show a positive trend in sales growth that has allowed them to differentiate themselves from the rest of the companies in terms of performance measurements, especially since 2009. Export orientation has also improved performance. This is the strategy with the highest impact over the whole period of study, and it is safe to state that non-exporting companies show, in many cases, negative values in performance measurements.

Finally, it is worth noting that the economic crisis has prevented the expected takeoff in terms of demand for EAFRD funds. Differences were observed only in the first year; they have not been sustained over time. The volume invested by cooperatives has slowed down because of the economic crisis.

In this context, wine cooperatives have had to reinvent themselves. They have emerged as agents resilient to the effects of the crisis; against all odds, they have maintained and even improved their performance indicators. This work has provided food for thought in understanding the strategies and adaptive capacity developed by cooperatives facing the financial crisis and the CMO Law reform. As for future lines of research, it may be possible to assess the study of these strategies and resilience to non-financial crises such as Covid-19.