INTRODUCTION

Globalization has played an important role in the intensification of international trade. Countries have engaged in strengthening foreign transactions aiming to provide their citizens with commodities they lack in exchange for those they produce in abundance. World trade has become a key aspect of the development of modern economies, especially because of its relevance to national income generation and the living standards of a country.

Particularly, Brazil has experienced interesting changes over the years. From 1997 to 2000, its trade balance registered negative figures, meaning that the import trade value of this nation surpassed its exports. As of 2000, the country has altered this condition and has developed its commercial structure to become a net exporter. Nevertheless, imports showed an average annual increase of 1.24% between 1997 and 2016, and nearly 138 billion dollars’ worth of imported goods in 2016 (Comexstat, 2018).

A closer look at the importing schedule of Brazil allows us to note that the country mainly imported nuclear reactors, electrical machinery, mineral fuels, and vehicles in 2016. Conversely, its exports comprised oil seeds, ores, meat, and mineral fuels in that same year (Comexstat, 2018). In sum, we verified that the imports of Brazil were predominantly based on capital-intensive goods, yet its exports consisted largely of primary varieties. In addition, we also confirmed that, from 1997 to 2016, various Brazilian products faced direct competition from foreign-made varieties (PIA, 2018; Comexstat, 2018). In other words, Brazil both produced and imported a set of similar products, meaning that the local industry dealt with the challenge of competing against internationally-made products.

In this context, product quality assumes importance. Countries trading the same types of goods in the international market have more incentives to respond to import competition by differentiating themselves in terms of the quality of these products (Amiti & Khandelwal, 2013). Bastos and Silva (2010) and Jaimovich and Merella (2015), for instance, observed a positive association between higher-quality products and productivity, wages, prices of goods, and income, resulting in a possible improvement in the terms of trade.

Brambilla and Porto (2016) determined that quality production is closely connected to skills and concluded that skilled workers develop better varieties and require higher pay. Amiti and Khandelwal (2013) investigated how import competition affects the decision of a firm to improve product quality. These researchers noticed that industries facing international competition have an extra incentive to enhance the quality of their output and compete against foreign goods.

Data from PIA (2018) and Comexstat (2018), which combine information on wages paid in Brazil and the quality of imports (import trade value divided by quantity), respectively, identified those products facing direct foreign competition in Brazil. These data also shed light on a possible correlation between the quality of imports entering the Brazilian market and the wages paid by those firms competing. The channel connecting these ideas implies that the quality of products exported to Brazil could put pressure on domestic firms that produce similar goods to modify the production process, become more intensive in skilled labor, enhance product quality, and consequently pay higher wages. In other words, the production of higher-quality goods requires skilled workers who earn more (Brambilla & Porto, 2016).

In this paper, we aimed to investigate the causal relationship between the quality of imports and wages paid in Brazil from 1997 to 2016. Specifically, we examined whether the quality of imports originating from the main trade partners of Brazil impacts wages paid in those sectors facing direct foreign competition. Our hypothesis was that local Brazilian firms respond to foreign high-end competition by hiring skilled workers who earn higher wages. For this reason, we expected a positive association ranging from import quality to the level of wages paid by the Brazilian sectors competing internationally. Our analyses considered the top 60 exporters to Brazil between 1997 and 2016 or approximately 90% of the total imports of the country combining information on quality and wages at the product level.

Our main contributions to the existing literature are threefold. First, we conducted an investigation on the causal effects of quality on wages paid in the destination country. Brambilla and Porto (2016), for instance, analyzed the correlations between quality and wages paid in the exporting country. Second, we assessed whether international higher-end goods impact wage bands differently; that is, whether lower or higher paying sectors are more or less affected by the quality of foreign varieties. Third, we took into consideration that richer economies tend to produce and export higher-quality goods (Hallak & Schott, 2011; Hummels & Klenow, 2005; Schott, 2004) and carried out an additional analysis regarding the income structure of the main trade partners of Brazil. We assumed that imports from higher-income nations affect Brazilian wages differently with respect to those from poorer economies.

In terms of decision-making, our research contributes to shaping adequate policies with a focus on quality and career advancement in Brazil. Our results work in favor of the government efforts to protect Brazilian producers and to provide firms with the necessary means to improve product quality. Furthermore, our findings allow lawmakers to evaluate the need for labor qualification incentives and technology adoption subsidies.

The remainder of the paper is organized as follows. The second section presents the theoretical background on which we relied. The third one introduces the methodology and a thorough description of our data. To end, the fourth section discusses our results, and the fifth one concludes.

I. THEORETICAL FRAMEWORK

Previous studies devoted considerable attention to investigating the relationship between skill upgrading and wages (Bernard & Jensen, 1997; Juhn, Murphy & Pierce, 1993). These works widely observed that wage discrepancies are mainly attributable to rises in skill upgrading. Nonetheless, these studies did not take into account the eventual effects of skill upgrading on the quality of the output.

Verhoogen (2008) advanced on the works of Bernard and Jensen (1997) and Juhn, Murphy, and Pierce (1993) and proposed a quality-upgrading mechanism linking trade and wage inequality. The author considered that varieties differ in quality and suggested that the production of higher-end ones requires skilled workers, and that a qualified workforce should be paid more. Brambilla and Porto (2016) presented a framework to provide a theoretical basis for the association raging from product quality to wages paid by exporters of high-end goods. Their model relies on the mechanism that rich countries demand quality and that the supply of quality is intensive in skilled labor and involves higher wages. In this paper, we followed this very same link for the quality of imports. The rationale behind this is that to compete against foreign-made varieties, local Brazilian firms that manufacture similar products might offer higher wages to attract skilled professionals and produce higher-quality goods.

We adopted the model of Brambilla and Porto (2016), aiming to establish a theoretical framework for wage increases (as a result of hiring qualified workers) in response to higher-quality import competition. The model presented by those authors considers a differentiated variety k with quality

Similarly to Verhoogen (2008) and Brambilla and Porto (2016), we regarded that wages increase in skills. Therefore, we had to consider that quality production demands high-quality labor, which is costly to obtain. To model quality production, Brambilla and Porto (2016) followed Kugler and Verhoogen (2012) and Hallak and Sivadasan (2013) and assumed that this production represents a combination of skilled labor S and capability

where

where wk

represents the wage offered to skill level Sk

and

Equations (1) and (2) illustrate a shortened version of the quality mechanism proposed by Brambilla and Porto (2016), in which quality production requires skills and higher-quality workers earn higher wages. The simplified mechanism presented here could also occur when analyzing the effect of the quality of imports on wages. Foreign competition may encourage domestic firms to become more competitive against imports by improving local product quality. To face international competition, firms resorting to enhancing the quality of the output might want to hire skilled workers who can manufacture better products. Consequently, these firms would need to respond to a higher-quality workforce by providing them with higher wages.

Lastly, this theoretical framework shows that firms might choose to increase quality and this raises average wages. These worker-quality wage schedules can be justified on the basis of a couple of other complementary models besides that of Brambilla and Porto (2016). For instance, Kremer (1993) rationalized such an idea through a model in which worker quality represents general skills, workers have heterogeneous skill levels within each occupational category, and plants must pay high wages to attract skilled workers. Finally, Akerlof (1982), Shapiro and Stiglitz (1984) and Bowles (1985) presented a model in which worker quality represents effort and plants do offer efficiency wages to induce workers to supply it.

II. METHODOLOGY

This section is divided in four parts. First, we expand on the proxy used to estimate the quality of Brazilian imports. Second, we present our empirical model. In the third part, we elaborate on our empirical strategy and, finally, we show the source of our data.

II.1. The quality indicator (unit value)

One common limitation of the existing trade literature is the difficulty in defining the quality of the output. Product quality variations represent a broad concept encompassing varied features, such as product performance, durability, reputation, and cultural aspects specific to the origin country, which are complex to measure (Pinheiro, Markwald & Pereira, 2002).

Some researchers have discussed the challenges to measure quality (Schott, 2004; Hummels & Klenow, 2005; Hallak, 2006). Ramos Filho, Medeiros, and Albuquerquemello (2017) noted that data on the quality of internationally traded varieties are scarce, possibly due to the subjective nature of quality. These authors highlighted that the information on quality involves different nations, each with its specificities, making this measurement even more difficult.

Previous studies have attempted to infer the quality of the output indirectly, by observing, for instance, output prices or unit values1. The unit price (i. e., the total industry export/import value divided by the quantity exported/imported by the industry) indicates a common proxy variable to measure quality, meaning that greater unit prices result in higher-quality goods. Hence, we applied such a proxy to evaluate the relationship between the quality of imports and wages.

Schott (2004) argued that better-endowed nations use their endowment advantage to produce vertically superior varieties; in other words, goods that are relatively capital- or skill-intensive and demonstrate added features or higher quality, thereby requiring a comparatively higher price. More recently, Anwar and Sun (2018) showed that the industry export quality is directly related to the industry export price. These authors confirmed that the effect of foreign direct investment on industry export quality can be identified from its impact on the industry export price, thus providing a theoretical justification for a number of empirical studies, where the export unit value is used as a measure of product quality.

II.2. Empirical specification

We present our specification to investigate the relationship between the quality of Brazilian imports and wages paid by those sectors that manufacture similar products domestically.

where Wk,t refers to the total wage bill2 paid by a set of firms producing good k 3 in the importing country (Brazil) at time t (1997-2016), as in Brambilla and Porto (2016) and Flach (2016)4.

One significant feature of Equation (3) is a novel perspective regarding the analysis of quality. Unlike Brambilla and Porto (2016) and Verhoogen (2008), in this equation, we explored the effects of the quality of the output on wages paid in the importing country. Contrarily, the aforesaid authors evaluated the impact of quality on wages paid in exporting countries.

In this model, the variable of interest

GDPpct refers to the per capita gross domestic product of Brazil in t. Estimates for this control variable were expected to generate positive and statistically significant coefficients, meaning that an increase in the Brazilian product could positively affect the average wages paid in that country. This assumption is based on the early findings shown by Brambilla and Porto (2016), in which the authors identified a positive correlation between product level and wages.

Outputk t corresponds to the gross value of industrial production6 of product k in the importing country (Brazil) in t. The coefficients for this variable, as found in Brambilla and Porto (2016), were expected to exert a positive and statistically significant effect on wages paid in the importing country, suggesting that products generating higher revenue in a given sector or industry would have a positive impact on wages.

To end,

II.3. Empirical strategy

To identify whether the quality of imports impacts wages in Brazil, we first estimated Equation (3) using the ordinary least squares (OLS) estimator. We considered that the quality of goods shipped to Brazil –our variable of interest– is set in the origin country. We assumed that features regarding durability, performance, reputation, country-specific aspects, technological development, and design, among others, embodied in those products exported to Brazil are defined where they are obtained and do not depend, for instance, on the wage bill of firms producing similar goods in Brazil. That is, our variable of interest is taken as given from the point of view of our model. This means that import quality is not explained within Equation (3); it is exogenous. Hence, the quality of imported goods sent to Brazil is not conditioned by wages paid by those local sectors facing direct foreign competition. This does not indicate, however, that there is no connection between such variables; the quality of imports is able to affect the system without being influenced by it.

In addition, in Equation (3), we added control variables and fixed effects to avoid omitted variable bias. This econometric issue occurs when a statistical model excludes one or more relevant variables. As presented in Section 3.2., we inserted predetermined controls (GDPpc and Output); covariates that are not themselves outcomes of our treatment variable. Moreover, we included origin country and product effects in our model to control for unobserved aspects of the main trade partners of Brazil, as well as product-specific features of imports. Had we not accounted for the above, the error term in Equation (3) would be correlated with our key variable and our estimate results would attribute the effect of the omitted variables to the quality of imports. Therefore, our study not only reports correlations, which cannot be interpreted as causal effects, but also represents an example of an investigation with causal inference.

Second, we estimated the unconditional quantile regression approach proposed by Firpo, Fortin, and Lemieux (2009). This method allowed us to analyze the effects of the independent variables presented in Equation (3) on different wage quantiles. Based on an influence function, it considers that regressors may have a contrasting impact across the quantiles of the distribution; that is, import quality can affect lower- and higher-paying sectors in Brazil facing import competition differently.

Along with the unconditional quantile regression method, this study also uses the concept of Recentered Influence Functions. The influence function IF(w; v, ,Fw) consists of the relative effect (influence) of each observation on a distribution statistic v(fw) . The incorporation of v(fw) in the influence function defines the so-called Recentered Influence Function or RIF. This method made possible to assess the effects of a set of covariates on the statistical distribution of interest: in this case, the distribution of quantiles.

The τ-th quantile

where

Then, the RIF, which replaced the dependent variable Wk,t

in the unconditional quantile analysis, was defined by the sum of the distribution statistics and their respective influence function,

where

From that, the model assumed a covariate vector X and the conditional expectation of the RIF as a function of X, i. e.,

where w refers to the total wage bill paid by firms producing good k in Brazil at time t;

The unconditional quantile regression approach proposed by Firpo, Fortin, and Lemieux (2009) used in our paper differs from the conditional quantile regression presented by Koenker and Basset (1978). While the latter approach solely allows within-group estimations, the former makes possible the analysis of both within- and between-group effects.

II.4. Data

We used product level annual data from 1997 to 2016. The timeframe comprises the years after the Brazilian trade openness, in which the country underwent many transformations and was able to develop its trade until recent years (Ipea, 2010).

We applied data from multiple sources. Information on wages comes from the Pesquisa Industrial Anual (PIA), corresponding to the 4-digit level of the Classificação Nacional de Atividades Econômicas. These were then converted into 8-digit product level data of the Nomenclatura Comum do Mercosul (NCM) through the correspondence tables from the Instituto Brasileiro de Geografia e Estatística. The cross-country data on Brazilian import values (US$) and quantities (kg) are from Comexstat. The classification of products in this database also followed the NCM. Data on GDP per capita, PPP (current international US$) of Brazil are from the World Bank. To end, data on gross value of industrial production (US$) were collected from the PIA.

III. RESULTS

This section is divided into two parts. The first one shows the descriptive statistics of the variables used. The second part presents the results of the fixed effects and the unconditional quantile regression models relating the quality of Brazilian imports and wages paid by sectors producing similar goods nationally.

III.1. Descriptive statistics

Prior to detailing the results of Equation (3), a descriptive analysis is presented to provide a better perception of the sampled partner countries and the Brazilian product-level data. Table 1 shows averages, standard deviations, and extreme values for wages paid in Brazil, the quality of imports, import values between 1997 and 2016, import quantity, GDP per capita, output, and the number of observations of our baseline sample.

Table 1. Summary statistics of the variables included in this study

Note:Quality refers to the logarithm of the unit price (import value divided by net weight). Numbers rounded to two decimal places.

Source: Authors’ own calculations.

The average wage paid by firms manufacturing a given product k in Brazil was 869 million dollars. The highest wage was noted for ‘Petroleum oils, oils from bituminous minerals’ (NCM 27101999), reaching 27 billion dollars’ worth of wages in 2016. The lowest value for this variable was 661 thousand dollars and was recorded by ‘Coal gas, water gas, producer gas and similar gases, other than petroleum gases and other gaseous hydrocarbons’ (NCM 27050000) in 1999.

Quality presented extreme values ranging from -7.31 to 15.43. The highest quality level was associated with imports of ‘Hormones, prostaglandins, thromboxanes and leukotrienes; their derivatives and structural analogues’ (NCM 29375000) exported from Canada in 2015. The lowest quality value corresponds to imports of ‘Acids; saturated acyclic monocarboxylic acids; acetic acid’ (NCM 29152920) shipped from Germany in 2016.

Table 1 also shows that, between 1997 and 2016, exports to Brazil from its main trade partners reached, on average, 1,4 million dollars and 1 478.53 tons. The GDP per capita in Brazil varied from 8 547.34 dollars in 1998 to virtually 16 thousand dollars in 2014.

The variable output presented a mean value of 7.59 billion dollars and extreme values varying significantly with a high standard deviation of 13.9 billion dollars. This may indicate a large discrepancy between production levels in Brazil. The lowest output level was for ‘Precious metal ores and concentrates; excluding silver’ (NCM 26169000); its output equaled 2.76 million dollars in 2006. The highest output level was observed for ‘Petroleum oils, oils from bituminous minerals’ (NCM 27101999), totaling an amount of 352 billion dollars in 2016.

This analysis of Table 1 reveals that the highest output was registered by ‘Petroleum oils, oils from bituminous minerals’ (NCM 27101999), which also presented the highest figures for wages. The association between output and wages could certainly be noted given that higher levels of production require a larger number of workers and, therefore, this results in greater volumes of wages.

This preliminary evaluation confirms a positive correlation between output and wages. However, it does not provide a consistent basis to draw further conclusions regarding the relationship between the quality of imports and wages. This study considered solely the Brazilian products that face import competition. Therefore, the quality of imports may have a contrasting effect on wages paid in Brazil, regardless of how large the output level of that product is.

Table 2 presents descriptive statistics for the variable quality considering the income groups of the main trade partners of Brazil7. A significant number of empirical papers studying trade prices predicted a positive relationship between the income per capita of a country and average trade prices, suggesting that high-income countries consume and produce goods of higher quality (Hallak, 2006; Hummels & Klenow, 2005; Schott, 2004). In this context, having a deeper understanding of the income structure of the main countries exporting to Brazil between 1997 and 2016 allowed us to sketchily infer some features of the quality of Brazilian imported goods.

Table 2 reports that nearly 80% of our sampled countries have a high-income structure, which suggests that most Brazilian imports consist of better, higher-quality goods. High-income origin countries also show the greatest mean value for the variable quality, indicating that countries in this grouping export, on average, higher-end goods to Brazil.

Lower middle-income economies represent only 5.7% of our baseline sample. Although these countries have a slightly similar mean value (in comparison to high-income ones) for the quality of their exports, the standard deviation for this grouping is relatively high and the number of observations is drastically smaller. This suggests that the subsample is rather heterogeneous.

Table 2. Mean value and standard deviation of the variable quality for income subsamples

Source: Authors’ calculations.

Source: Authors’ own calculations.

Figure 1. Density distribution of the variable quality by partner income groups

Figure 1 complements the previous analysis and shows the distribution of the variable quality for the income subsamples presented in Table 2. The top-left panel refers to the quality of imports originated in the main trade partners of Brazil. The remaining panels analyze the distribution of the variable quality for high-, upper middle-, and lower middle-income origin countries.

We identify in Figure 1 that the variable quality is distributed similarly to a normal distribution for all income groupings. However, there are slight differences among them. Most observations in the panels representing both the full sample and high-income partners lie in a higher-density region compared to the bottom panels. Such a finding is not surprising whatsoever, given that most Brazilian imports originated in countries with a high-income level, as shown in Table 2.

The most apparent discrepancies are in the quality of imports shipped to Brazil from upper and lower middle-income countries. Comparing these two subsamples reveals that the mean value for upper middle-income exporters skews a bit to the left tail, showing moderately lower quality levels. On the other hand, the bottom-right panel implies a lower density or a greater variation among quality levels. Such variability may be related to a more limited capacity of lower middle-income economies to enhance the quality of their exports homogeneously. In other words, some of these countries may not have the necessary productive means to improve the quality of certain goods.

Table 3 shows the mean value of the quality of exports sent to Brazil for fifteen selected industries (HS02), along with their origin countries and income groups8. The industries presented in Table 3 are those registering the highest quality levels between 1997 and 2016. Therefore, these industries comprise those imports with the highest quality levels, which might stimulate competition in the Brazilian market.

Table 3 presents a better picture of the product categories that most promote import competition in Brazil. The list in this table encompasses varied industries and consequently a large number of products. As can be seen, the highest quality levels are registered for ‘Aircraft, spacecraft, and parts thereof,’ ‘Optical, photo, technical, medical, etc. apparatus,’ and ‘Pharmaceutical products.’ The quality figures for these industries were predictable, given that these imply capital- and skill-intensive products.

Table 3. Average quality of Brazilian imports for selected industries between 1997 and 2016

Source: Research data.

Most high-end selected industries presented in Table 3 originate from high-income countries, with the exception of ‘Articles of apparel, accessories, knit or crochet’ imported from Romania, confirming the analysis from Table 2. Among the fifteen highest-quality industries, ‘Articles of apparel, accessories, not knit or crochet,’ ‘Articles of apparel, accessories, knit or crochet,’ ‘Nuclear reactors, boilers, machinery, etc.,’ and ‘Headgear and parts thereof’ were those with the lowest average quality levels, originated in the United States, Romania, Chile, and Taiwan, respectively.

The analyses performed in this section aim to provide a first look at our data, as well as to deepen the understanding of Brazilian products competing against foreign-made goods. Nevertheless, for more conclusive evidence, the following subsection deals with the results of the econometric estimations, which offer a more precise verification of the assumptions and analyses we proposed.

III.2. The quality of imports and wages paid in Brazil

We now show the estimation results regarding the causal relationship between import quality and wages paid by sectors facing import competition in Brazil from 1997 to 2016. First, Table 4 introduces the results of the OLS fixed effects model. Then, Table 5 displays the estimates of the RIF regressions for the unconditional wage distribution quantiles of the logarithm of annual wages. Table 6 advances a little on the results displayed in Table 5 and considers the income groupings of the main trade partners of Brazil.

Table 4 provides a more general analysis of the effects of the quality of imports entering the Brazilian market on wages paid in the country. Alternatively, Table 5 uncovers the effect of import quality upgrading on different wage quantiles. The estimated coefficients of the RIF regressions have shown variations along the wage distribution quantiles with respect to the estimated coefficients for the mean. Therefore, these results reinforce the need to use the unconditional quantile regression approach.

From Table 4, we infer that, for most OLS-FE regressions, there exists a positive and statistically significant relationship between the quality of Brazilian imports and local wages, meaning that as the quality of imports increases, wages paid in Brazil are affected positively. Similarly, Brambilla and Porto (2016) also found a positive association between these two variables. Nevertheless, these authors investigated whether the quality of exports influenced the average wage paid in the exporting country.

As noted in Table 4, from the perspective of import competition, the quality of imports entering the Brazilian market has produced a positive effect on local wages. The probable channel causing such an increase relates to the need for the workforce to develop skills and, consequently, be more capable of enhancing the quality of domestically produced goods.

Table 4. OLS-FE estimations

Note:The dependent variable is wages. Controls in all columns: exporting country effects, product effects (HS04). Standard errors in parentheses. Significance at 1% level indicated by *** and non-significant indicated by NS. Numbers rounded to three decimals.

Source: Research results.

Like Brambilla and Porto (2016), we considered that the production of high-end goods requires skilled professionals who subsequently are paid higher wages. Thus, through skill upgrading, local firms manufacturing the most varied products k are able to produce higher-quality goods and compete against imported higher-end products, as noted by Maia (2014).

Estimates of import quality, shown in columns (1), (3), and (5) of Table 4, indicate that such a variable has a rather small effect on wages paid in Brazil. Probably, the reason for this is that import quality affects Brazilian wages indirectly via skill upgrading. Hence, results in Table 4 suggest that as the quality of Brazilian imports increases, there could be domestic pressure for local firms to enhance the quality of their product. To do so, Brazilian firms might respond to this pressure by hiring qualified professionals who earn higher wages.

Table 4 shows differing estimations checks. Though we included exporting country and product effects in all regressions, in columns (1)-(5), we can observe that as we consider predetermined variables (GDP per capita and output), the estimated parameter of import quality reduces. This means that had we not added these covariates, we would probably have generated biased estimates of the impact of import quality on wages. When comparing estimates of import quality in columns (1) with (8), the direction of such a bias is evidenced. The negligence of relevant variables, as shown in column (1), produces an overestimated effect originating from high-quality imports and Brazilian wages.

Table 4 also reveals other variables producing a positive effect on Brazilian wages in those products facing import competition. Throughout regressions (3), (4), and (5), the coefficients for the variable GDP per capita confirm our assumption that this variable would have positive and statistically significant values. These results indicate that an increase in the Brazilian product causes a rise in the average wage of the country. In sum, an increase in the domestic product may be due to an expansion in the number of workers, which consequently has a ripple effect on the overall wage level. As noted by Gremaud, Vasconcellos, and Toneto Junior (2012), as the economic activity grows, unemployment reduces and wage rates tend to rise.

The coefficients for the variable output also exhibited a positive association with our outcome variable. This result shows that an increase in the output generates a rise in wages paid in Brazil. As firms producing variety k expand their production, they require a larger number of workers and, for this reason, the overall wage bill increases. To illustrate such a finding, Brambilla and Porto (2016) affirmed that a group of higher performance firms manufacturing product k would have the necessary means to pay higher wages.

In a nutshell, Table 4 reveals that import quality causes a rise in the wage bill of those firms facing import competition in Brazil. Nevertheless, we know that import competition might generate variations in wages differently; in other words, lower and higher paying sectors might respond contrarily to the pressure of foreign competition. Hence, Table 5 presents the results of the unconditional quantile regression, which tackles this possible issue and provides more consistent estimates.

Similar to Table 4, the results shown in Table 5 suggest a relatively small effect of the quality of imports on the wage distribution quantiles. More specifically, the coefficients for the quality of imports reveal a positive correlation with the dependent variable for the first two wage quantiles, q10 and q30. This indicates that lower wage levels suffer an increase of 1.60% and 1.04% for the q10 and q30 quantiles, respectively, as the quality of imports rises.

Table 5. Unconditional quantile regression estimation

Note:The dependent variable is wages. Controls in all columns: exporting country effects, product effects (HS04). Standard errors in parentheses. Significance at 1% level, indicated by ***. Numbers rounded to three decimals.

Source: Research results.

Brambilla and Porto (2016) found that wages and skills are closely intertwined and that skilled workers are paid higher wages. For this reason, goods of lower-paying firms are more likely to be produced by low-skilled workers. We believe that the positive association between quality and the lowest bands of the wage distribution occurs because low-skilled workers show a greater potential for skill upgrading, given that, unlike qualified workers, they are more distant from the skill frontier. In other words, low-skilled workers have a wider spectrum to learn a skill. Thus, they are more apt to respond (via skill upgrading) to the pressure caused by the quality of international goods.

Our results align with Aghion and Howitt (2006) and Aghion et al. (2009) and the findings of Amiti and Khandelwal (2013), who noted that import competition could cause higher wages (via demand for skilled workers). These authors highlighted that the escape-competition effect might induce firms to invest in quality enhancement to survive competition from potential new entrants.

The analysis of higher quantiles reveals an opposing relationship between quality and wages with respect to lower wage bands. We found negative and statistically significant coefficients for all upper quantiles, that is, q50, q70, and q90. These parameter estimates imply that as the quality of Brazilian imports increases, there exists a decrease in wages paid by firms producing those corresponding goods locally. Comparing q70 with q90, we verified that the wage reduction is even higher for the extreme quantile. The results of Table 5 demonstrate that the quality of foreign goods entering the Brazilian market would cause a wage reduction of 0.70% for the q90 quantile.

The negative relationship between quality and upper wage quantiles could be better perceived from the probable skill endowment of the workers comprising the higher-paying firms. The upper band of the wage distribution encompasses those firms paying the highest wage levels for a given product k. Hence, these are the firms whose workers tend to be highly skilled. Given that high-skilled workers have a narrower range for skill upgrading or, in other words, are closer to the skill frontier, enhancing the quality of the domestic output might not be feasible.

Our findings follow Amiti and Khandelwal (2013), who also observed that import competition discourages those distant firms from investing in quality upgrading, because they might simply be unable to compete against potential new entrants. Then, a worst-case scenario could be imagined where firms may end operations and workers are likely to lose their jobs. Thus, firms most prone to close induce an increase in the supply of skilled workers, causing employment in that industry to inevitably decline and wages to face cuts, as noted by Chamon (2015).

GDP per capita and output present a positive relationship with the dependent variable across the wage distribution quantiles, as shown in Table 5. The magnitude of such a relationship, however, varies as different quantiles are considered. The estimates of the GDP per capita have a greater impact on wages for the q50 and q70 quantiles. Gremaud et al. (2012) confirmed that, as the product grows, unemployment rates fall and wages tend to increase. A possible explanation for this specific upward movement could be that, as the economic activity of Brazil expands, the set of firms paying the wage bands considered in the q50 and q70 quantiles are those demanding the highest number of workers. Consequently, these firms hire more, and the wage level in those quantiles presents a more significant rise. Output did not show a large discriminatory effect across the quantiles analyzed, implying that the effect of the output onto contrasting wage levels is somewhat homogenous.

Even though results in Table 5 reveal that there exist differences in the way the quality of foreign varieties interact with wages paid in Brazilian firms producing similar goods, we also noted (as shown in Table 4) that the magnitude of all the coefficients are fairly small. For this reason, our findings evidence that import quality has a minor effect on wages paid in the destination country, probably because such an effect is manifested indirectly through skill upgrading.

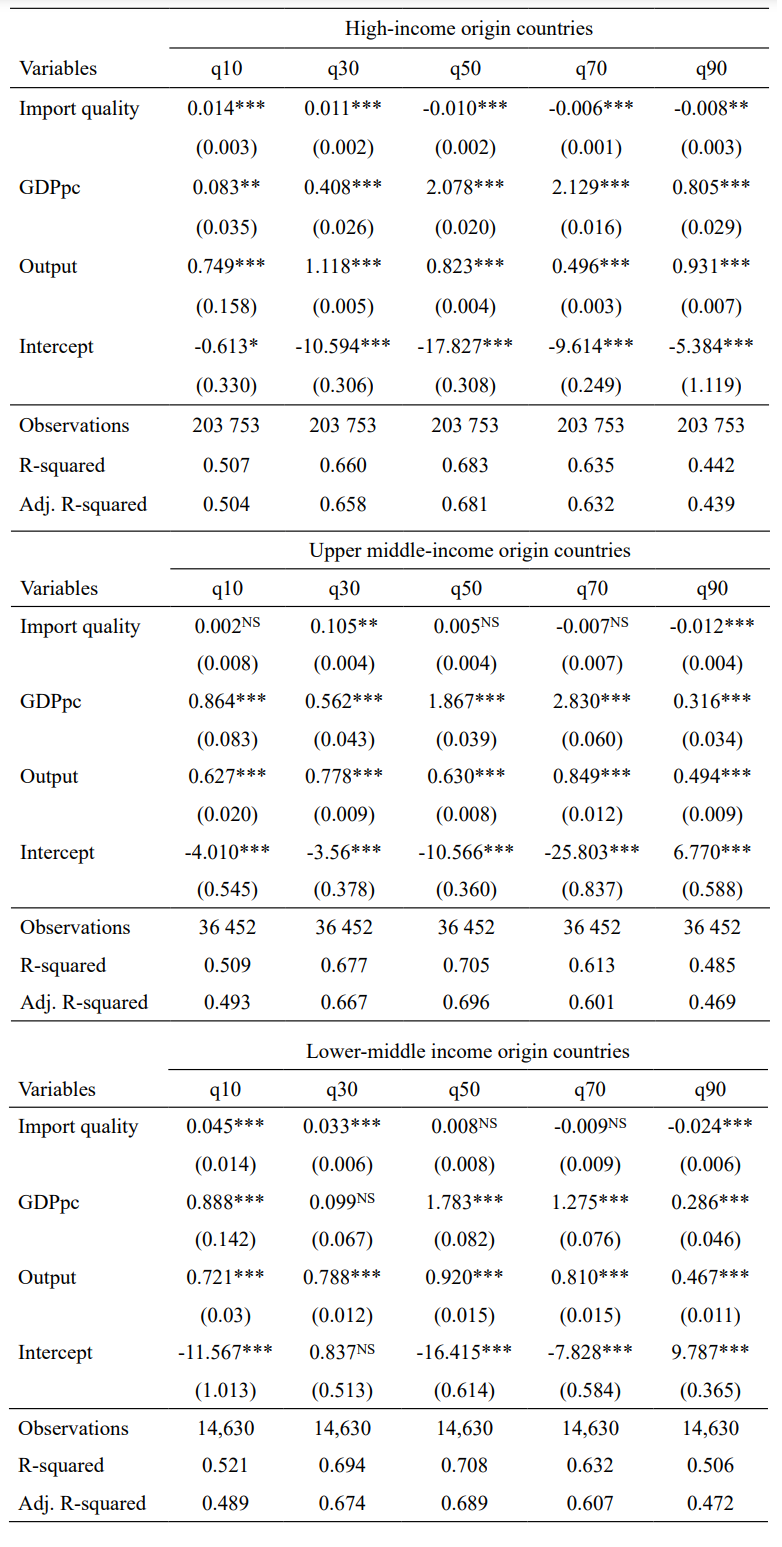

To advance our investigation a bit more, we had to consider that richer economies demand and produce better higher-end varieties (Brambilla & Porto, 2016; Caron, Fally, & Markusen, 2014). Hence, Table 6 presents the results of the RIF regressions for three origin country income groups: high-, upper middle-, and lower middle-income economies. These results provide an additional analysis and verify whether the quality of imports originated in richer countries has a contrasting impact on wages paid in Brazil.

Table 6. Unconditional quantile regression estimations for origin country income groups

Note:The dependent variable is wages. Controls in all columns: exporting country effects, product effects (HS04). Standard errors in parentheses. Significance at 1%, 5%, and 10% levels indicated by ***, **, and *, respectively. Statistically non-significant values indicated by NS. Numbers rounded to three decimals.

Source: Research results.

By reducing the sample to high-income origin countries that exported to Brazil between 1997 and 2016, we found that the coefficients for import quality varied insignificantly with respect to the full sample (Table 5). This finding is not surprising, since most trade partners of Brazil are high-income economies, as shown in Table 6. Consistently, the effect of the quality of imports on wages paid in Brazil is small. This suggests that the quality of products exported to Brazil from rich economies positively affects the lowest quantiles of the wage distribution and that the quality of imports has a negative impact on the highest bands of the wage distribution, as noted for the full sample.

Regarding the comparison among income groups, we expected that the estimates for high- and upper middle-income countries would yield higher coefficients for the variable quality vis-à-vis those observed for lower middle-income origin countries. This relationship relates to the income structure of the richest exporting country, which, in theory, is better endowed in terms of capital and skilled labor and, consequently, has the necessary means to manufacture higher-quality products (Brambilla & Porto, 2016).

Nevertheless, the results of Table 6 for lower middle-income countries show that as the quality of goods sent to Brazil increases, its effect on the wage bill is higher than when these products come from richer nations. We considered that the outcome of this estimation could be understood from the possible scope of lower quality of imports produced in poorer economies entering the Brazilian market. As Caron, Fally, and Markusen (2014) noted, richer countries have the potential to produce higher-end varieties. For this reason, we assumed that products originating from lower middle-income economies are of inferior quality in respect of those from richer nations. These imports produce a more substantial effect on wages paid in Brazil, since the quality gap between domestic and foreign products is narrower. Then, local firms respond faster to import competition through skill upgrading, which translates into a rise in local wages.

Our results are consistent with the distance-to-the-frontier models discussed by Amiti and Khandelwal (2013). These researchers affirmed that the relationship between import competition and quality depends on the distance of the product from the quality frontier. Their study is based on the model of Aghion and Howitt (2006), which allows the relationship between competition and innovation to depend on the distance of the product from the quality frontier. Their model highlights two forces. First, for firms far from the frontier, an increase in competition reduces the incentives to innovate, because ex-post rents from innovation are eroded by new entrants. Second, as firms get closer to the frontier, competition may increase the incentives to innovate, because it reduces firms’ pre-innovation rents by more than it decreases their post-innovation ones.

Therefore, products shipped from lower middle-income countries to Brazil might be closer in quality to domestic ones compared to foreign-made varieties from richer nations. These goods, in turn, offer local firms an incentive to enhance the quality of those manufactured domestically and thus compete against international products. To improve the quality of the output, local firms feel the need to hire qualified professionals, who are paid higher wages.

Another possible reason why the quality of goods sent to Brazil from all the various income groupings behaves according to the results presented in Table 6 is the demand-side driver. For instance, Brambilla and Porto (2016) and Caron, Fally and Markusen (2014) discussed the intensity of trade among rich nations. For the authors, since richer economies demand and produce higher-quality goods, consequently, trade between rich economies is more intense, especially in higher-end varieties. According to the World Bank (2019), Brazil is considered an upper middle-income country, meaning that its population consists of consumers that are moderately demanding in terms of quality, but not to the extent as those from richer, developed economies. These perceptions could explain why the quality of imports produces a rather small effect on wages paid in Brazil from the demand-side perspective.

Finally, Table 6 evidences that, for all income groups, GDP per capita affects wages positively across all wage distribution quantiles. Based on the coefficients, it is not possible to observe a clear pattern among income groups. Similarly, output did not show any strong evidence that such a variable may affect wages differently when contrasting income groupings.

CONCLUSIONS

In this study, we investigated whether the quality of imports causes variations in the wage bill of the Brazilian sector facing import competition from 1997 to 2016. On average, our results show a positive effect of the quality of imports on Brazilian wages, suggesting that as the quality of imported goods increases, so does the average wage in Brazil. Nevertheless, when conducting the analysis to contrast wage quantiles, we found that the quality of foreign products in the Brazilian market affects wage bands differently. This revealed that the quality of imports has a positive effect on lower band wage quantiles. Contrarily, the upper band quantiles of the wage distribution exhibited a negative relationship with our key variable: import quality.

We also provided an additional analysis and validated whether quality affects differing wage quantiles when considering the income levels of the exporting country shipping its products to Brazil. Our findings indicated that the quality of imports originated from poorer economies affects wages paid in Brazil slightly more in respect of richer countries (high- and upper middle-income nations).

Our study unveiled that the effect of the quality of Brazilian imports on wages is rather small. We identified this outcome in the analysis of the full sample regressed on average wages, and along the wage distribution quantiles for the whole sample, and also when taking into account the income differentials of the origin country, regardless of their relationship (positive or negative). We considered that the magnitude of our estimated coefficients shows the indirect association between the quality of foreign goods in competition with locally produced varieties and its effects on wages paid in Brazil between 1997 and 2016.

Throughout all of our analyses, we gathered evidence of other variables affecting wage levels in the Brazilian economy. The investigation of the connection between the gross domestic product and wages paid by firms producing goods that face import competition, as well as the association between output and wages, uncover that as the average per capita product and output increase, wages are positively affected. A similar result is also consistent across differing wage quantiles and for various origin country income groups.

With respect to limitations, our study addressed the challenge of working with product-level data. Information on wages refer to the total wage bill paid by a set of firms producing a given product k. The use of more disaggregated information, at the firm level, for instance, would have the potential to capture the differentiating components of goods exported to Brazil within each firm. This means that each firm could export differing variations of products in terms of quality and direct them to various markets. Data at the firm level could also provide more precise information on wages paid by each firm facing import competition instead of the sum of those from a whole set of local organizations.

Another limitation of this article is the proxy for the quality of imports. Although it has long been addressed in several papers in the trade literature, recent studies have not yet found common ground regarding an ideal measurement of such a variable. Future research on the topic might as well explore the quality estimation more intensively to attempt and approximate a more genuine quality measure.